About Us

Game On, IRS! is focused on freeing you from the grips of the IRS. The emotional stress caused by tax debt is crippling to your well being and affects the entire family. With an arsenal of experience, we are familiar with the struggle and commit to ease the burden through every step in the process.

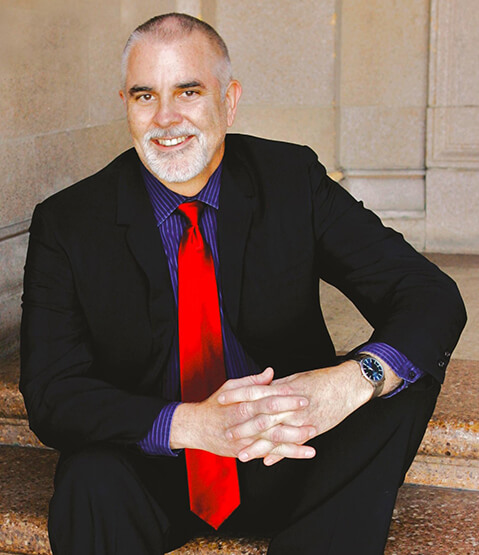

Jeff Johnston

Director of Tax Resolution

Past President, Golden Gate Society of Enrolled Agents

Director, Board of Directors, California Society of Enrolled Agents

Vice-Chair of Audit, California Society of Enrolled Agents

Mr. Johnston earned his law degree (JD) from John F. Kennedy School of Law in the Bay Area as a second career adult student at the age of 50. Mr. Johnston passed the bar exam in California (the hardest in the nation) and continued with an advanced law degree (LL.M.) in Taxation from Golden Gate University in San Francisco. From that point in his career, Taxation was his “core area of competency”, legalese for specializing or taking only new clients with tax issues. Hence, his practice is limited exclusively to tax-related matters.

Mr. Johnston teaches other tax professionals across the nation on tax resolution. He is an NTPI Fellow and Instructor, a tax resolution designation issued by the National Association of Enrolled Agents (NAEA) that focuses exclusively on tax resolution. Mr. Johnston teaches in the NTPI three year program and very much enjoys working with students wanting to specialize in tax resolution by working thru case studies and real-life situations for handling various types of IRS levies, liens, garnishments, settlement offers, payment plans, and other types of tax controversy cases.

Mr. Johnston is a Director on the Board of Directors of the state-wide tax professional organization, the California Society of Enrolled Agents (CSEA). He was previously the Vice-Chair of Education and now serves as the Vice-Chair of Audit at the state level. Mr. Johnston is the Immediate Past President of the Golden Gate Society of Enrolled Agents in the Bay Area after having served as Education Chair, Director on the Board, and subsequently President.

Many of Mr. Johnston’s clients also have real estate related issues, which is a particularly good fit for his because he has been a licensed real estate broker in California since 2001, earned the CCIM designation for commercial real estate, owned a mortgage brokerage firm in Texas, taught Property Law at the University of Silicon Valley Law School, and now advises clients on how to protect or save their real estate from seizure by the IRS.

Mr. Johnston works with Spidell Publishing, a California company that focuses on continuing education for tax practitioners in California. He introduces tax resolution to thousands of CPAs, Enrolled Agents, and tax attorneys across 20 cities in Northern California each year. Similarly, Mr. Johnston helps select speakers and topics for the CSEA annual convention and introduces tax resolution to 1,000 attendees at their three day annual conference each year.

There are seemingly way too many available acronyms to go behind his name, which demonstrates his passion for professional advancement and continuing education. Graduating law school at age 50 and continuing with the additional programs noted above make him the poster child for second and third career adults.

Mr. Johnston enjoys remaining current on new tax law and helps form future tax law when he visits California State Senators and Assemblymen at the State Capitol in Sacramento annually, advising them on what bills are presently under consideration in the legislative session and the impact they will have on you, their constituents.

Mr. Johnston is licensed federally by the Department of Treasury, which allows him to practice before the Internal Revenue Service at all levels and before the California Franchise Tax Board (FTB) on income tax matters, Employment Division (EDD) on employment cases, CA Department of Tax and Fee Administration (CDTFA, formerly the BOE) on sales tax disputes, Office of Tax Appeals (OTA, similar to US Tax Court) for appeals of lower decisions on income tax and sales tax, and CA Unemployment Insurance Appeals Board (CUIAB).

Mr. Johnston has argued cases before the California agency deciding cases on appeal from income tax and sales tax issues, previously known as the Board of Equalization, now known as the Office of Tax Appeals, as well as appeals from EDD before the CA Unemployment Appeals Board on employment tax cases.

Mr. Johnston is licensed federally by the US Department of Treasury under Circular 230 and regulated by the Office of Professional Responsibility (OPR), which entitles him to practice in all fifty states, unlike CPAs and attorneys that gain their access under state supervision and thus limited to their specific state of licensure.

For real estate related matters in California, Mr. Johnston is regulated by the Department of Real Estate as a Real Estate Broker in California. Real estate transaction representation is available upon request for existing tax matter clients or others in exceptional cases by request.

Mr. Johnston married and relocated to the Sacramento area, maintaining offices in downtown San Francisco and Sacramento. Offices in the city are convenient to the IRS Office of Chief Counsel (where US Tax Court cases are supervised) and in Sacramento where all the California state agencies and State Capitol legislative offices are headquartered.

Mr. Johnston loves encouraging others to continue striving in their educational goals to become better practitioners and business owners in their own trade. If you like to learn, you’ll enjoy working with him.

Meet our Tax Professional Partners

Sommerset Maughan

Assistant Managing Director

Donec ultricies nibh ac nulla fire hunting, id efficitur est pretium. Duis iaculis auctor purus non eleifend. Pellentesque mollis bibendum ante, sed gravida nulla. Curabitur et aliquet justo, eget bibendum ipsum. Suspendisse vel augue sit amet tortor pellentesque congue. Sed eget arcu nibh. Mauris dictum vestibulum mi vitae pharetra.

Hanelli Schopenhauer

Director of Finance

Donec ultricies nibh ac nulla fire hunting, id efficitur est pretium. Duis iaculis auctor purus non eleifend. Pellentesque mollis bibendum ante, sed gravida nulla. Curabitur et aliquet justo, eget bibendum ipsum. Suspendisse vel augue sit amet tortor pellentesque congue. Sed eget arcu nibh. Mauris dictum vestibulum mi vitae pharetra.

Assistant Director of Finance

Assistant Director of Finance

Donec ultricies nibh ac nulla fire hunting, id efficitur est pretium. Duis iaculis auctor purus non eleifend. Pellentesque mollis bibendum ante, sed gravida nulla. Curabitur et aliquet justo, eget bibendum ipsum. Suspendisse vel augue sit amet tortor pellentesque congue. Sed eget arcu nibh. Mauris dictum vestibulum mi vitae pharetra.

Bill Clark

President of Human Relations

Donec ultricies nibh ac nulla fire hunting, id efficitur est pretium. Duis iaculis auctor purus non eleifend. Pellentesque mollis bibendum ante, sed gravida nulla. Curabitur et aliquet justo, eget bibendum ipsum. Suspendisse vel augue sit amet tortor pellentesque congue. Sed eget arcu nibh. Mauris dictum vestibulum mi vitae pharetra.

How can we help?

With our years of hands on experience, we understand IRS expectations and know how to achieve desired results, as painlessly as possible. We are here to help resolve your tax problems. You are one step closer to resolving your tax debt, once and for all.

IRS Bank Levies

Penalty Abatements

Liens

Delinquent Tax Returns

Offers in Compromise

Payroll Tax Problems

Wage Garnishments

Installment Agreements

FOIA Requests

IRS Audits

Bankruptcies

Transcript Analysis

“You reduced my taxes way more than I imagined. I’m definitely glad I hired you.”

“You took time on a Sunday to help me. That was impressive!”

“I am rich only in your friendship. You saved us and I will be eternally grateful.”

“Miracle worker! You’re amazing. Thanks so much!”

“I will highly recommend you and would use you again in a heartbeat!”

“You rock! Thanks so much for everything you did.””

“I’m 1,000% on board with you. So glad I put my trust in you.”

“Wow, what a great result! I can’t believe it’s done already!”

“You were super friendly, very knowledgeable, and highly competent.”

“You saved me way more than I could have on my own.”

“You fixed mistakes by my prior tax guy and will save me a ton of money in the future.”

“You worked tirelessly with courteous personalized service in a timely manner.”

“I’m in tears right now. My family can eat again. You have no idea!”

“You found mistakes in my old returns that blew me away. I’m impressed!”

![]()